When Revenue based financing(RBF) is better funding option compared to a bank loan.

There are different financing options available for a company. The choice of financing vary as per need (amount) and in many cases, the availability. There are situations where Revenue-based financing (RBF) is the best option for a company to go for. It depends on different factors, situations, time and need of the company. RBF has probably the fastest loan in terms of approval, with approvals taking less than 24-48 hours in some cases. Although the bank’s interest is lesser than RBF there are many points on which RBF still is a better option compared to a bank loan. So let’s look into the situations when Revenue-based financing(RBF) is better than a bank loan.

Fast Loan Approvals time

Yes, as mentioned above, Revenue-based Financing has the fastest approval timing ranging from 24 hrs to a maximum of 7 days for a very bigger amount. If you see the bank loan approval timings, it exceeds 3 months. This is because they have a length scrutinization, verification, documentation process.

Least Documentation required.

To get approval for the Royalty based Financing loans.

- You just need to submit an online application.

- Three months of your business checking statement, reflecting revenues of at least $7000.

- Three months of your most recent Merchant Processing statements if you charge by credit card.

Now compare this to the bank’s documentation requirement where they check your 6 months statement expecting higher revenue. They do their risk assessments and will do a thorough scrutiny of your financial statement.

No Collaterals required

In revenue or royalty-based financing, there is no collateral to be kept for availing a loan. Thus no collateral or guarantee is required as in case of bank loans.

No interference, or restriction on the purpose of using the amount

In RBF you are free to use your funds with no restriction. No banking regulations or no issuance mandate is observed in Revenue-based financing

How Revenue-based Financing lending Firms afford to issue funds so fast, without much documentation and no strict collateral requirements?

To answer this question, we need to think from the lenders perspective.

From Lender or RBF providing firm’s perspective following are the advantage compared to banks.

From a lender’s perspective, Revenue-based financing charge more than a bank. The repayment cap + tax rate makes the payment amount bigger by 1.5x to 2.5x

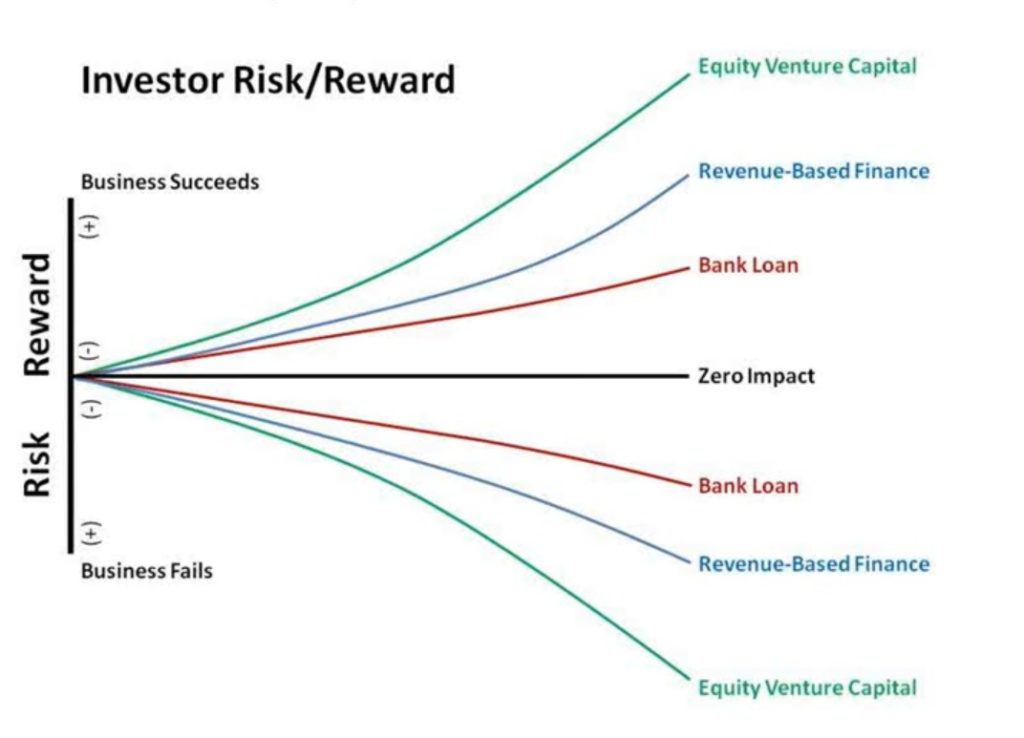

But the return on investment is much lower than an equity investor. Revenue-based financing really does fit right in between 1)bank financing and 2) equity venture capital on both the risk side.

On the lender’s side, RBF firms charge more than a bank but certainly, it’s lender’s potential earning is much lower than an equity investor. On the other side, since RBF lenders are getting monthly payments back, right after month one, by this time lenders are already doing better than an equity investor, so that good if the company is were to fail.

Since in RBF they don’t keep any personal guarantee or collateral if the company were to fail the investors of the Revenue-based financing makes little to nothing but certainly are not recovering nearly as much capital as a bank loan or with lesser protective provisions from a bank.

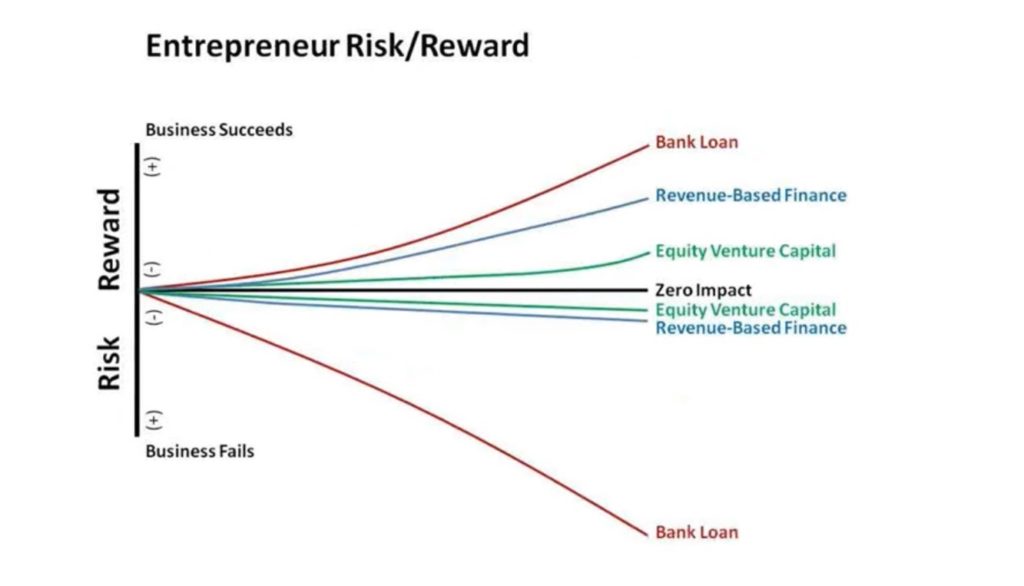

From the Business side or entrepreneur’s perspective, RBF providing firm’s perspective following are the advantage compared to banks.

From the entrepreneur’s perspective, if the company fails, there is no personal guarantee or personal recourse back to the management. So if the company fails it actually behaves much more like equity.

If the business succeeds the cost of capital is slightly more than a bank loan but way too less than equity financing.

So, to conclude the business or the entrepreneur gets the best of both worlds. If a company fails it behaves much more like equity and if the company fails the amount is slightly more than and way too less than a bank loan.