Being a startup company there are various challenges as well as constrains to raise funding for your company. Early-stage companies with their limited market knowledge or experience only approach Angel Investors, VCs or banks for those initial funding.

Often, angel investors cannot provide capital to scale.

The problem with Angel Investors is the amount they provide. Angel investment starts with $10,000 and on average, the angel investment is around $77,000. As per an article in forbes, the average check written by individual angels is $36,000 and the median is $25,000, but they also saw a broader range, from $5,000 to $100,000 for the most part. There are several reasons for this. In most cases the angel investor invests their own money, there is always a problem with the investment amount being very small. There is a solid reason why the amount is so less. The Angel investments are high-risk, which is why this strategy normally doesn’t represent over 10% of the investment portfolio of any given individual. Angel Investor funding is suitable for the following types of startups

- Startups with very less or No financial backing

- Startups with no certain track record to prove their ability in executing the designed plan

- Startups in the very nascent stage or are in its primitive stage of development

Banks require collateral small startups can’t provide

Banks cannot risk on startup so easily. They require a safe or clear business model projecting growth. The documents to support growth. But the foremost reason why a bank is a difficult option for tech start-up is, they require collateral or guarantee for risk aversion. That becomes the biggest barrier, that the banks possess a relative risk aversion attitude. Bank’s funding is suitable for the following types of startups

- Startups with solid business plans and a vivid projection they can show banks of growth (even if the growth is not higher)

- Startups with Non-Bad credit history

- Companies which can wait or sustain the approval cycle of a minimum of 6 months

Problems startup tech companies face while raising funds from VCs

VC’s maybe the favorite options for funding among tech startups but this mode of funding has its own drawbacks and lacunas.

VC’s financing requires a company to share ownership

From a study of Howard’s business review, it is learned that ‘Fewer than 1% of startups raise capital from VCs or Venture Capitalist. There are many reasons for it. First and foremost is that the VCs asks for the share in the company. Thus, VC’s focused on investments that result in a sizable exit. If a start-up accepts VC money at the early stage they may have to lose a chunk for a small amount received via funding.

VC’s focused on investments that result in a sizable exit

Often times VC’s are a very good option when the owners or the founders are open to sharing ownership of the company according to their relative percentage agreed upon. The only major concern with the VC funding besides sharing ownership is that the VC’s “go big or go home” mentality, VCs often aren’t satisfied with a few million exits. That is the reason why Venture Capitalists are highly selective in choosing the company with explosive growth potential, making funding, a very lengthy process. VC funding is suitable for the following types of startups

- Startups open to ownership sharing

- Startups which has a clear explosive growth potential plan through which they can convince VCs

- Companies which can wait or sustain the approval cycle of a minimum of 3 months

Other sources of financing with lesser hassle

There are many options available where the above hassles and formalities can be bypassed. Most of them have a unique funding model. This is to ensure a seamless funding process.

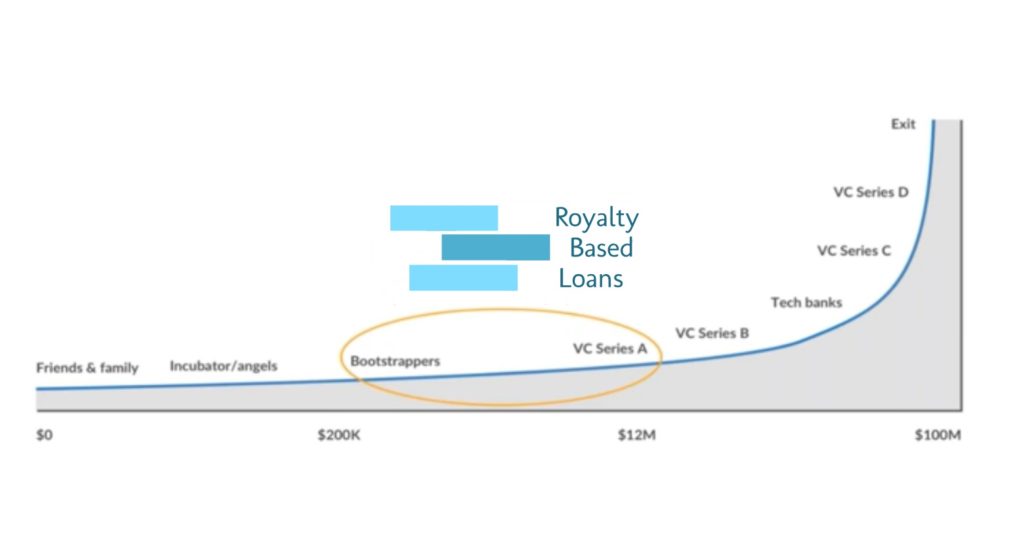

Royalty Financing or Revenue-based financing

This type of financing doesn’t require any collateral, nor guarantee for approval. The approval process takes as little as 24 hours. The best thing about royalty based financing is its repayment process. Repayment depends on the fixed percentage of generated monthly revenue. So you don’t need to pay for the month your company does not generate revenue. Total repayment amount, also known as Repayment Cap is between 1.5x to 2x of the loan amount and no equity share nor collateral on the stake. Thus, it is essential to understand where this Revenue bases financing fits in the funding cycle.  Startups may think of Revenue-based financing options after the angel investment from friends or family or seed capital received from an institutional equity investor. But where it really can play well is to add the growth capital in that stage from when the company receives a small seed investment or a bootstrap. Therefore, the company’s trying to extend to a VC Series A and increase the valuation in the metrics or essentially if they want to maintain continue to bootstrap they take a high-value loan from us this provides quite a bit of runway to fuel the growth of the company and opens up other financing options. So, to sum up, in Revenue based financing fits in these few conditions

Startups may think of Revenue-based financing options after the angel investment from friends or family or seed capital received from an institutional equity investor. But where it really can play well is to add the growth capital in that stage from when the company receives a small seed investment or a bootstrap. Therefore, the company’s trying to extend to a VC Series A and increase the valuation in the metrics or essentially if they want to maintain continue to bootstrap they take a high-value loan from us this provides quite a bit of runway to fuel the growth of the company and opens up other financing options. So, to sum up, in Revenue based financing fits in these few conditions

- For Bootstrappers: They grow faster without giving up equity or control

- Companies seeking the first round of VC funding: These companies can improve metrics and demand a higher valuation.

- Startups with Bad credits

- Startups with No collateral

- Startups who don’t want to share the ownership as in case of Equity or VC financing.

Apply now our partner Yalber offers up to 500K in Royalty based funding within 48 hours. No credit score and no collateral required. Just 3 months in business with at least 7K in monthly sales.