As seen revenue-based financing (RBF) is one of the fastest modes of financing where the loan amount can be secured in 24 to 48 hours. All this even when companies have a poor credit score, plus there is little to no collateral required, making RBF a borrower-friendly financing option. It is also one of the easiest & fastest modes of receiving business financing. This is because of the following.

One of 3 C requirement is fulfilled

Remember the three C ‘s of Lending that is Cashflow, Credit, Collateral for revenue-based financing if you have (as a borrower) one of the ‘C’ they typically don’t need the other. All you need to do is,

- Submit an Online application

- Submit: 3 months of your most recent business checking statement showing revenue of at least $7000.

- Submit: 3 months of your most recent merchant processing statements if you are charged by credit card.

RBF is between Equity and Banking-finance

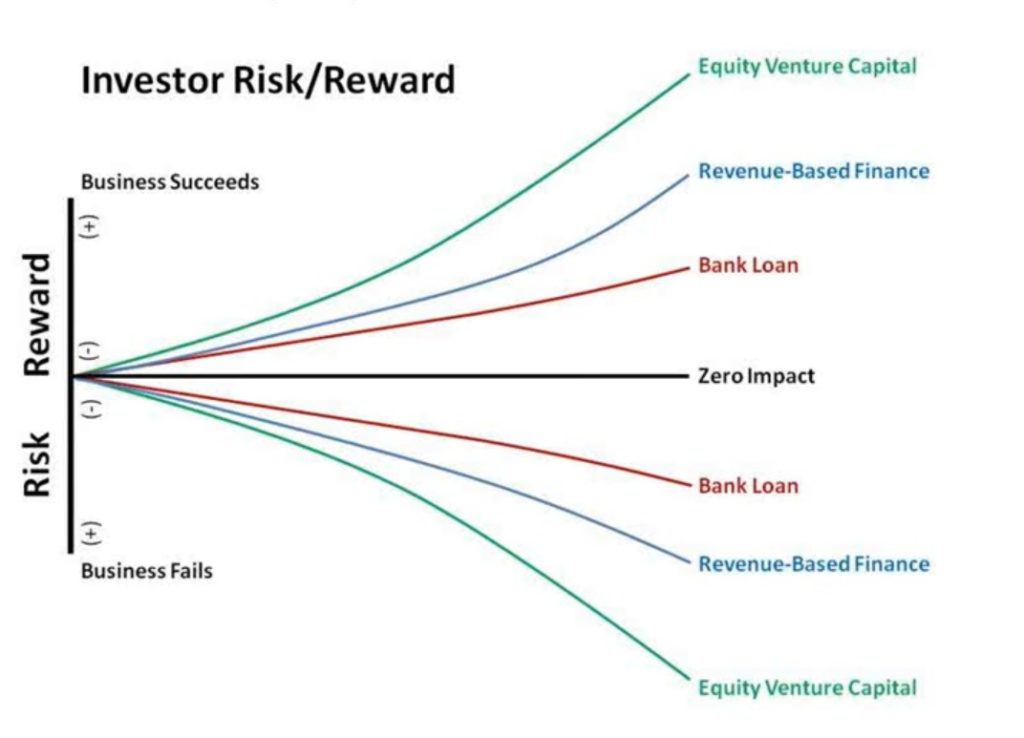

Revenue based financing fit right in between “bank financing” and “equity venture capital” refer the above graph. On both the risk side and on the reward side. RBF charge more than a bank but certainly RBF’s potential return on investment is much lower than an equity investor. On the other side, RBF because they are getting monthly payments back right after month one, they’re (Revenue-based financing) already doing better than an equity investor.

Revenue based financing fit right in between “bank financing” and “equity venture capital” refer the above graph. On both the risk side and on the reward side. RBF charge more than a bank but certainly RBF’s potential return on investment is much lower than an equity investor. On the other side, RBF because they are getting monthly payments back right after month one, they’re (Revenue-based financing) already doing better than an equity investor.

The loan gets repaid faster

The entire loan recovery time for the lender is much lesser than compared to equity or a bank. As the loan amount is directly proportional to the ‘growth revenue’ of the company. Thus, it becomes crucial for lenders to lend to a company projecting profitable revenue. A loan typically gets paid in a maximum of 5 years or less. With the type of repayments model in RBF, where a company’s growth rate directly speeds up the loan payback, it takes 3-5 years in a normal case, for a loan to fully get paid. Thus a lender (financing company) gets his investment back much quicker than a banking or SBA loan for that matter.

Repayment cap amount: High risk in a shorter span

The repayment cap is a multiple of the principle balance. This repayment cap is agreed upon by the lender and the borrower before the disbursement of the loan amount. So if you qualify for $200,000 and with the repayment cap is called 1.5 X. The amount owed to the lender over that period time would be roughly $350,000 (+ some nominal tax amount) so the final amount would be approx. $350200. Conclusion To conclude, revenue-based financing easy way of getting funding for the following reasons

- It is based on High risk for a lesser amount of time. As a result, the lender earns 1.5x to 2x times of principle amount in less than 5 years.

- Faster repayment of lender’s money (by the borrowers)

- The risk is distributed or spread evenly across the borrower and the lender

- RBF funding model creates a win-win situation for lenders as well as borrowers, where they need less documentation, hardly any collateral and the fastest loan approval time.