Bootstrapped SaaS companies often approach Venture Capitalist (VC) after the initial level of finance from Angel Investors. It is probably the stage when the entrepreneurs realize that their ideas can really be materialized to create something big.

There are many stages of funding when you start a company from scratch, each stage has its own objectives, purpose, and goals. Things become even more complicated when fuinancing for a SaaS company.

With SaaS model companies it is always different than the company with Enterprise software model

The challenges of maintaining the annual recurring revenue (ARR), and the annual contract value (ACV), then the headache of churn rate can really dampen the spirit, the excitement of doing the business.

For SaaS companies, for their customers to get hooked or say to maintain retainer-ship, there is an additional responsibility of looking after the customer retention thing, which requires the customer engagement tasks. We would term this as “ To find a scalable way of acquiring users”

In the initial phase of the business with the ARR, ACV, churn rate to look after, followed by the low subscriber’s rate, limited financing the so-called “scalable way to acquire users” requires financing. SaaS companies at stage may think of raising the money. There are many options for financing charging fixed interest rate but the most popular one is the “VC financing”.

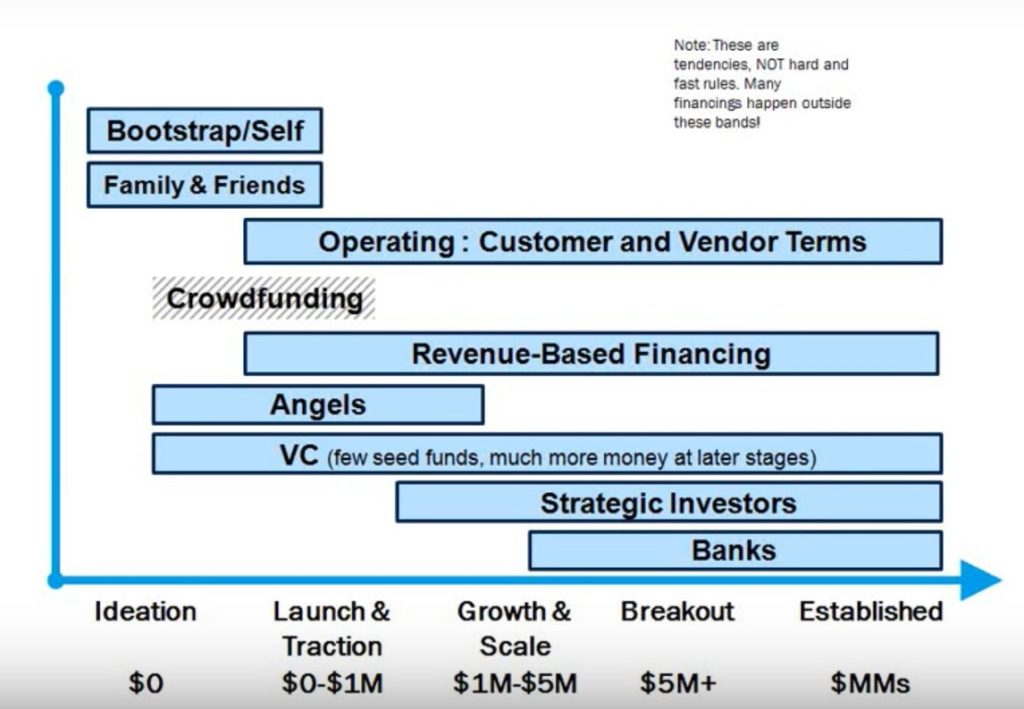

Thus, from the diagram, it can be seen that, after the initial stage of financing from angel investors, friends and family, the SaaS companies have the option of getting funded through VCs.

Read more: What is ARR, MRR ACV? How they drive SaaS business

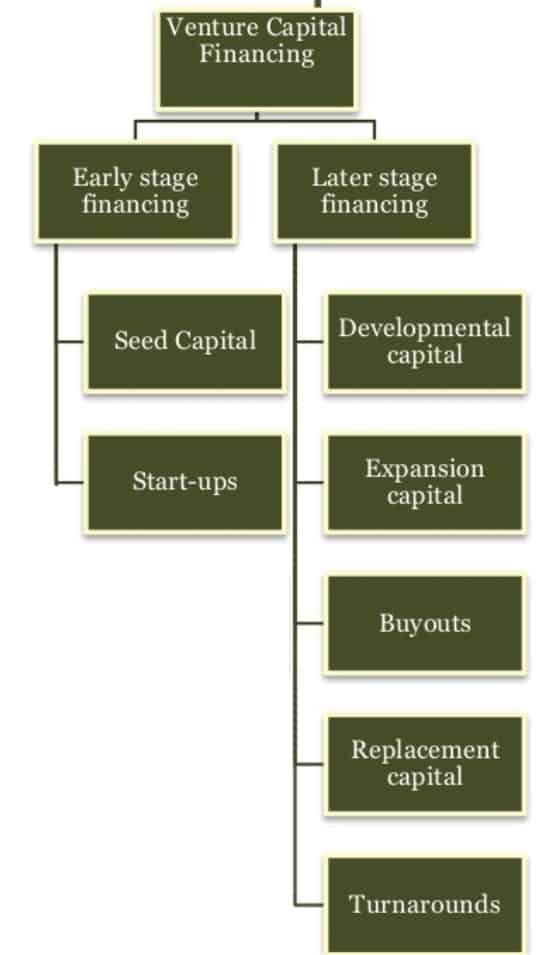

Stages of the VC financing

Referring to the diagram below. It can be noticed that the Early stage of the start-up consist of two stages 1) Seed Capital and 2) Start-up Capital

Early-stage VC financing

This stage consists of two phases 1) Seed 2) Start-up stage. This stage is all about taking an idea or a nascent technology and developing it into something that’s going to have high impact. Thus the capital required at this stage is limited to a few hundred thousand dollars. Typically Early-stage VC financing may require up to $500,000

Seed Capital: In the seed capital phase the VCs, they provide capital for translating the idea into a business proposition

Startup capital: This stage consist of the initial level set up where a prototype is being prepared. Here the entrepreneur is expected to provide a clear business plan to the investor.

The challenges of the initial stage of VC capital with SaaS companies

Although, VC firms provide capital, the strategic assistance, introduce the company to potential customers, partners, and employees; and much more.

So what’s the matter with VC financing?

In exchange for providing the above-mentioned facilities alongside the capital. VC firms may ask to seek the following position in the company.

- VC’s will typically obtain a preferred equity position in the company.

- Seats on the Board of Directors

- Veto rights

- Anti-dilution rights

- They may see their Involvement in making decisions related to your company.

Advantages of delaying VC funds? At Least in the Early-stage

As VC firms ask for equity, veto rights and other things as a part of the negotiation, there is no harm in giving away the part of equity, in fact, almost every company, at some point, gives out some part of their company in the form of equity.

There is a catch, it is always beneficial to give away equity in the early-stage. Early-stage financing requires not more than $500,000. Selling out equity for such a small amount is not the choice a SaaS company would like to exercise. Thus, it is best in the interest of the company that they increase its valuation (net worth) before giving away the part of equity.

So, in short, it is beneficial for a company can delay early-stage VC funds.

What are the alternatives for early-stage VC financing?

There are so many alternatives to Early-stage VC financing. There are many types of financing which provide up to $500,000 without seeking any equity or position in board or any of that sort. They are as follows

1. Small or Medium Business (SMB loans)

For those with strong or excellent credit, traditional banks are a great place to start searching for SMB loans. These institutions offer you flexible terms and low-interest rates with many of their financing solutions. It is a small business loan with a low fixed rate and low monthly payments.

2. Merchant cash advance

A merchant cash advance (or “MCA”) offers advance cash against your company’s future sales. This type of financing is generally available to businesses that have a steady volume of credit card sales, including retail stores, restaurants, and medical offices

Main Street Finance Group – Merchant Cash Advances, Lines of Credit, & Secured/Unsecured Loans

3. A business line of Credit

A business line of credit is a type of small-business loan that provides flexibility that a regular business loan doesn’t. With a business line of credit, you can borrow up to a certain limit — say $100,000 — and pay interest only on the portion of the money that you borrow.

4. Peer to Peer

Before crowdfunding like Kickstarter invaded your attention across the digital world, Peer to peer loans was the only option to get financing.

5. Crowdfunding

Crowdfunding is raising an amount of money from a large group of people (crowd). It happens mainly over the internet. There are platforms like Kickstart, Keutzal, Betabrand crowdfunding in generic as well as niche industries.

6. Revenue-based Financing

A Revenue-based Financing (or “RBF”) offers advance funding against your company’s future revenue. This type of financing is generally available to businesses that have a steady volume of sales, including retail stores, restaurants, and medical offices.

Following are the advantages of revenue-based financing

You can get up to $500,000 in the next 24 hours

Do you need to be just 3 months in Business?

No collaterals required

No Profits in your business yet? No Problem

Gain complete control of your business (no demanding equity or position in the board)

References

Research document paper on SaaS : https://en.wikipedia.org/wiki/Software_as_a_service

“SaaS Data Escrow International Report” (PDF). RainStor. Gloucester,