Revenue-based financing is the financing option wherein the repayment is based on the revenue generated per month by a company. One can avail the revenue financing up to 15% to 30% of the annual revenue. The final amount to be repaid is agreed upon by both the parties, also known as repayment cap.

Although the repayment cap is fixed, the periodic payback, which can be monthly (in most cases), quarterly (rare cases) or annually (rare cases) is based solely on a percent of the company’s revenue. More specifically, it’s based on a percent of the cash collected on a given month for the company. So, the periodic payback amount is not fixed but flexible, it flexes with the revenue and declines and increases in the revenue growth of the company. Thus, no revenue generated would be $0 as the repayment amount for that month.

Here are the situations where companies may find revenue-based financing as the best financing option.

It is for the projects or organizations with the high upfront cost

Higher up-front cost project includes SaaS-based small IT companies, construction company, restaurant, manufacturing company, etc. where there is a high investment for the initial installment to set up and the revenue starts only after that. Thus, to give the initial kick or boost or thrust.

It is the best fit for the projects with very low variable cost

Low variable cost projects have lesser dependability on external factors to manufacture goods or execute service. Generally, the risk to these company are low and thus companies with low variable cost can grab a Revenue-based loan on a good rate (low repayment cap).

Best for the entrepreneurs who don’t to give up a share

Without a question, one of the biggest advantages of Revenue-based financing is that unlike equity a borrower doesn’t have to give up its company shares during the initial stage when the company is set to take off. A borrower can save VC backed equity financing in the later stage after reaching a more higher stage.

Revenue financing is for the company requiring growth capital

This applies to mature businesses who want a relatively low capital or minority investments to expand or restructure operations, enter new markets, or drive a marketing campaign, etc. This may be for a shop renovation, a restaurant extending its seating capacity, etc.

It is for the companies having a long tail revenue stream.

A long-tail revenue stream is when Businesses sell low volumes of rare items to many customers instead of only selling large volumes of a reduced number of popular items. A longtail revenue stream involves the market. Thus; this type of business involved too an extent seasonal or Car rental, taxis, Design company, etc.

The company which has a SaaS model

These companies have a seasonal revenue model. So, in short, the revenue in these companies is seasonal. Revenue-based financing is perfectly suited for these companies as they pay the payback amount higher during the revenue season or in a constellation.

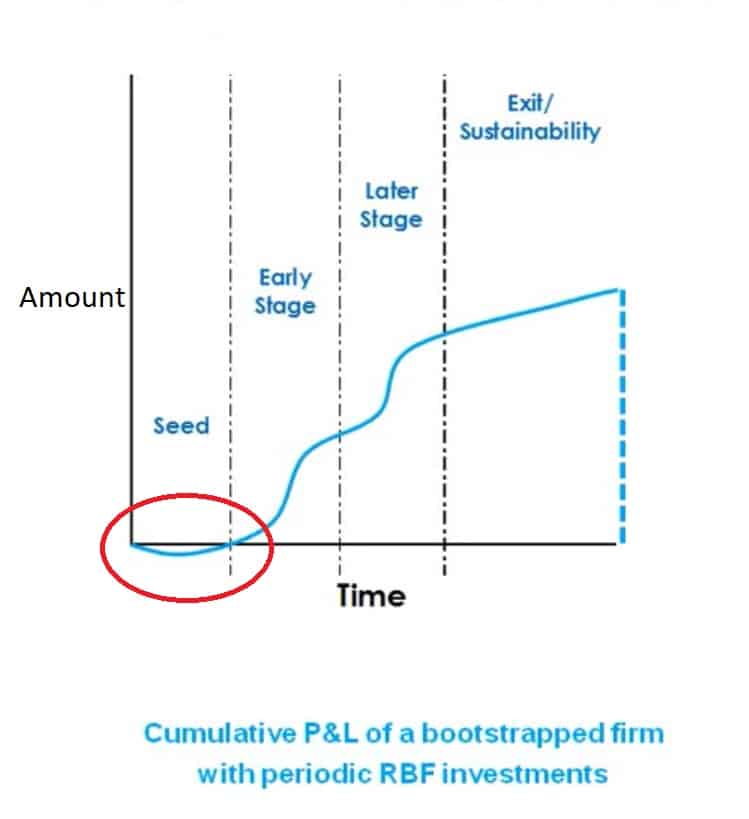

The company has a relatively flat J curve (marked red in the graph below)

Relatively flat J curve meaning they don’t exhaust too many funds initially.

These are the companies ready to fly or take off and are preceded by the seed capital or angel investment or are in the phase of the initial phase of investment. These companies can use a capital infusion to take on a new project or sales and marketing campaign and really accelerate to another growth level and then maybe take on another loan in the future and do it again and exit.

RBF best suits the company in need of urgent loan or financing

These companies mainly use RBF to grab the opportunity before it goes out of hand. This may include buying machinery on a good deal, there is a big order and need to fulfill the order but falling short of money to buy raw material.

The RBF suits well for the company required with little documentation and verification process

Often small businesses may not necessarily have every paper or document to avail a bigger amount. Revenue-based financing suits well in this situation as the borrower just needs to provide the read-only option to the company’s financial statement. This document is jus to verify the criteria of smooth growth or future growth opportunity for a company

Best suitable for the companies trying to keep control with them at the beginning.

It is the best option for the entrepreneurs who desired to keep control because unlike the VCs which is the favorite or the best available option the entrepreneurs in Revenue Financing you don’t need to require a lender to be the board member. At times this saves unnecessary interventions and thus the entrepreneur can fully concentrate on growing the business rather than worrying about keeping the external board members happy. Also, maintaining equity ownership and exiting earlier for a lower valuation is always a loss compared to but with higher ownership as opposed to taking on VC and being forced into the10x for the growth period of 7 to10 years.

Companies with No Collateral or guarantee

RBF doesn’t require you to keep anything in collateral or pledge any asset. So it’s the best financing option when you have no collateral to keep. This situation is typical for newly established entrepreneurs who are ready to boost bur required initial thrust.

RBF is well suited for the company with Bad rating

If your company has a bad rating due to the mistakes of the past banks often shuts their door a business owner has to rely on other sources for very high-interest value. This is not the case with the Revenue financing as you still may be liable to fundings without paying too much of higher interest.

Best for companies not desiring any intervention from the lender

Unlike equity, Revenue Financing requires no inclusion of their members on your board. This will not only eliminate any intervention from the borrower but also would allow the borrower (the company) to spend the amount without any restriction of convincing anyone.

This lets the company (borrower) spent independently without any supervision or regulation or authorization

Historically, RBF suits well for the high-risk projects

High-risk projects involve high capital requirements upfront. Historically royalty financing was best suitable for Oil mills, Gold mine, movie production typically falls under this, used revenue-based financing. Though that doesn’t remain the case anymore.

Revenue-based loan to open up other financing options

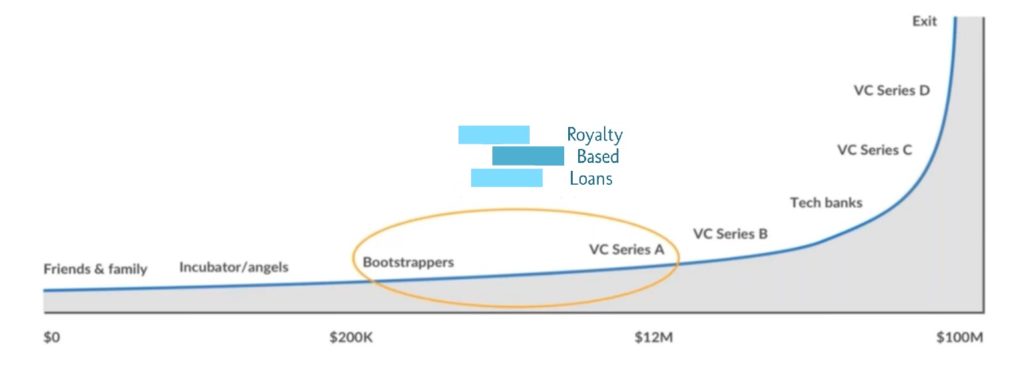

Institutional equity investor but we really can play believe well into the lifecycle is that we can add that growth capital in that stage from maybe a small seed investment or a bootstrap. of these, therefore, their company.

This is where we as a Royalty based Financing company fit in, The graph above highlights the ‘ lifecycle’ of a company often companies are coming to us after they’ve raised money from friends, family or receives angel investments in some cases even raised a seed investment from an institutional equity investor etc. Where we as a Revenue-based financing comes into picture is to add that growth capital, when they’re trying to extend to a Series A and increase the valuation in the metrics or essentially if they want to maintain continue to be a bootstrap, we can provide up to few million dollars to provide quite a bit of runway to fuel the growth of the company so that it opens up other financing options.